False Sureties: How to Recognize Them, Avoid Scams, and Defend Yourself

The phenomenon of false sureties (fideiussioni false) is rapidly growing in Italy: it’s estimated that hundreds of millions of euros in counterfeit policies circulate every year. This is a huge risk that can affect both companies and private individuals.

In this guide, you will find practical tools, checklists, and real-life cases to protect yourself from scams and defend your interests.

What is a False Surety?

A false surety is a guarantee that is counterfeit or issued by an unauthorized company. It should not be confused with a surety that is simply invalid (for example, because it does not meet the requirements of a tender).

The risks are extremely high: in addition to financial damage, you incur very serious legal and reputational consequences.

Contact us directly online for an immediate response, or call one of our nearest offices. Tel. +39 055 28.53.13 –Tel. +39 02 667.124.17

Email : info@italiafideiussioni.it

You can also contact us via WhatsApp: +39 339 71.50.157 send a message, and we will respond during office hours, within 5 minutes.

WhatsApp: +39 339 71.50.157 send a message, and we will respond during office hours, within 5 minutes.

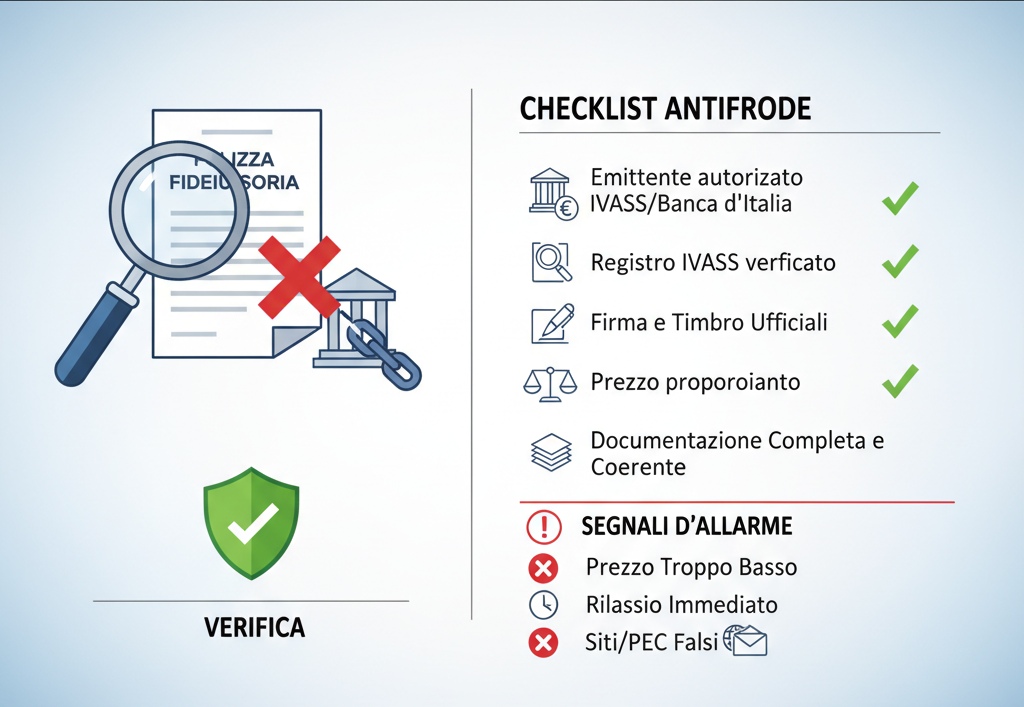

The Most Common Signs of a Counterfeit Surety

Here are some red flags you should not ignore:

- Extremely low price.

- Immediate issuance with no document request.

- Use of fake websites or PEC (Certified Email) addresses.

- Lack of registration with IVASS (Institute for the Supervision of Insurance) or the Bank of Italy.

- How to Verify a Surety

Here are all the tips from ANAC (National Anti-Corruption Authority) to protect yourself from fraud.

To protect yourself, always perform preventive checks:

- Reference Authorities: IVASS, Bank of Italy, or foreign supervisory bodies.

- Required Documents: IVASS registration number, stamp, and legal representative’s signature.

- Best practice: Contact the insurance company directly, not the contact details indicated on the document.

Discover how to verify a surety issued by a foreign company

The positive reviews from our clients are tangible proof of our excellence. Click here to see what people who have experienced our services are saying.

FAQ – How to Recognize a False Surety

Real Cases and Official Warnings

Case study 1: The Visenta Case

Case study 2: IVASS Warnings on Unauthorized Companies

Checklist for Recognizing an Authentic Policy

An authentic surety policy must have:

- Authorized issuing company.

- IVASS registration number.

- Legal signature and official stamp.

- Firma legale e timbro ufficiale.

- Price proportionate to the guaranteed amount.

What to Do if You Suspect a Scam

- Keep all documentation.

- Immediately contact IVASS (toll-free number 800-486661).

- Consult a specialized lawyer.

False sureties represent a concrete danger, but recognizing them is possible. The best defense is preventive verification.

Request a free, no-obligation quote now. Response within 24 hours .